WHEN CAN YOU START YOUR 401k, AND SHOULD YOU TIME THE MARKET?

You should start your 401K the first day you are eligible, which is the second first of the month after you were hired. We have many investments to choose from and that list has expanded due to our brokerage link offered from Fidelity.

WHY YOU SHOULD NOT TRY AND TIME THE STOCK MARKET

The majority of your investments in your 401k are in funds found in the Dow Jones, S&P 500, or the Nasdaq. Over the past 100 years investments in these indexes have done very well for employees. If you invested $100,000 into the S&P500 in 2000, you would have over $1,000,000 today. The S&P 500 has grown an average of about 9.8% a year in the last 20 years. I hear some people say they want to or can time the market, meaning they will cash out their investments and wait for the market to drop before moving your cash back into the market. Those people are NOT who you should be taking advice from. If you missed the top 10 best performing days of the S&P 500 since 2004, your average annual return would drop from 9.8% to just under 6%. If you invested for the last 30 years and missed the top 30 days your return would drop an astonishing 83%. So, trying to time the market is not a wise decision. Can you get lucky? Yes, but it’s not a sound successful economic strategy. Missing the best days crushes investor returns, its TIME, not timing that matter.

BAD DAYS HAPPEN, DON’T BE SCARED

For those of you who may be averse to risk, if you have been investing since 2000 you have had to deal with 2 of the 4 worst financial crises in the market history. The worst % drop in market history was Black Monday in October 1987, and obviously the crash of 1929 which triggered the great depression caused a lot of pain for investors. The other 2 were 9-11 and the great recession of 2008. Those years the S&P 500 dropped 21% and 38%. Losing that type of money is difficult to look at but if you did not take it out it all came back and then some. Many of us should remember just a few years ago how there was a quick crash after covid. The market plunged 34% between February 19 and March 23 and even dropped 12% in a day. Panic set in for many people who were thinking about retiring. Those that could not stomach the losses and sold, wished they hadn’t. The market came roaring back quickly and finished the year up over 18%.

WALL STREET WINS EVERY ELECTION

I have heard from some people discussing taking their money out of the market depending on who wins the November presidential election. Another idea the statistics show would be a bad idea. Under 4 years of Trump the S&P performed 2017 +21%, 2018 -4%, 2019 +31%, 2020 +18%, and under 4 years of Biden 2021 +28%, 2022 -18%, 2023 +24%, 2024 +22% as of 10-15, so your portfolio performed equally as well. At the time of this writing the DOW, S&P, and Nasdaq are at all time highs. Both Democrats and Republicans like money, so don’t think the election should deter you from potential gains no matter who wins.

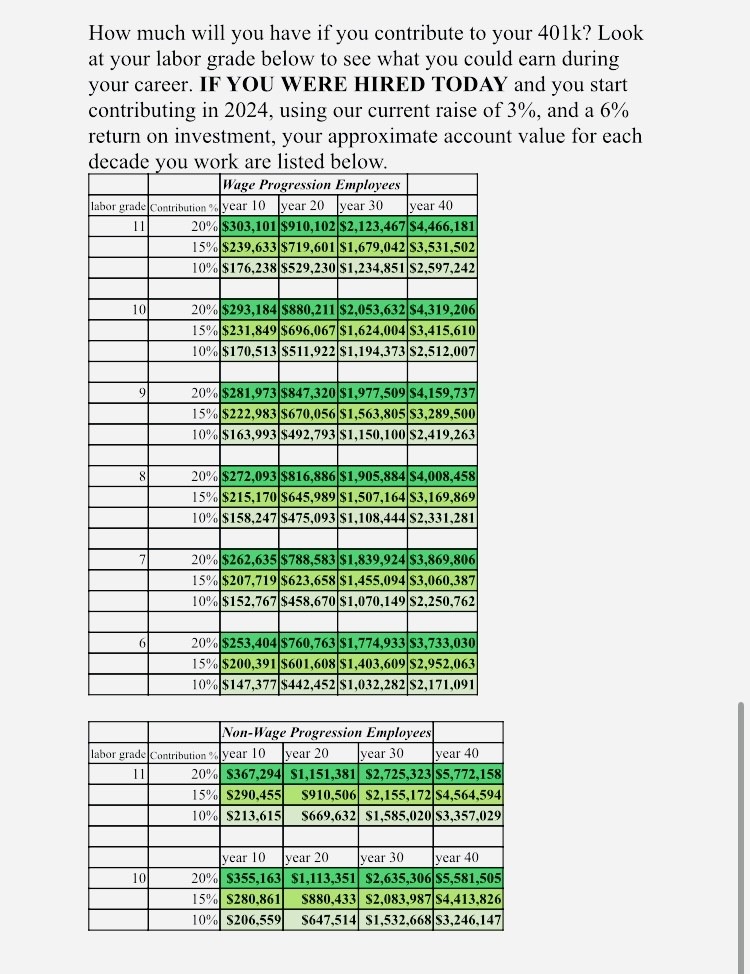

I will leave you with a quote from billionaire investor Ray Dalio “Cash is Trash.” If you had your money in cash the last few years it would have been taxed with inflation and you would have missed the gains that were needed to keep up with rising prices. I attached a spread sheet that was done earlier this year. It shows you what you could have if you started your 401K at your labor grade each decade for 40 years of employment at a very conservative return. Look at the numbers and if you have not started, please consider at least doing the minimum for company match.